Chargeback Representment Management

DisputeGenius™ helps merchants resolve chargeback disputes intelligently. Accept or dispute chargebacks with a single click.

Why Do I Need Chargeback Management?

Chargebacks are inevitable. Every merchant should try to prevent them as much as possible but the reality is some will always occur. But not every chargeback should simply be accepted. Because of friendly fraud and chargeback fraud, there are some chargebacks that should be fought and can be won. A good chargeback management solution can help merchants fight and win more of those chargebacks without requiring cumbersome amounts of time and effort spent on the representment process. You can reduce your time spent fighting chargebacks and recover more revenue.

Why Choose iConnectmedia?

iConnectmedia offers a representment solution service for merchants, DisputeGenius™, that is unlike anything else on the market. Our self-service solution is both highly customizable and easy to use. It allows you to generate dispute letters that fit every possible situation without requiring an extensive amount of time, effort, and representment expertise. Our solution will help you breeze through the representment process and recover more revenue. Processing chargebacks has never been easier.

Key Features of DisputeGenius™

Frequently Asked Questions

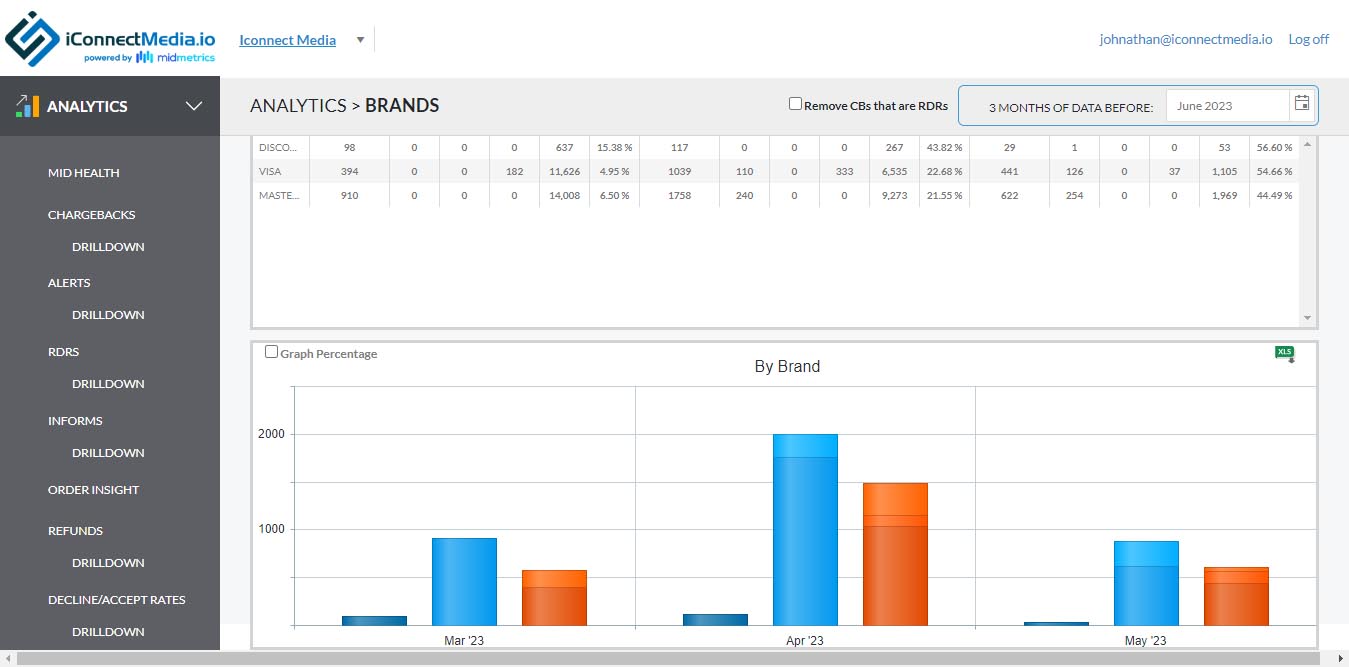

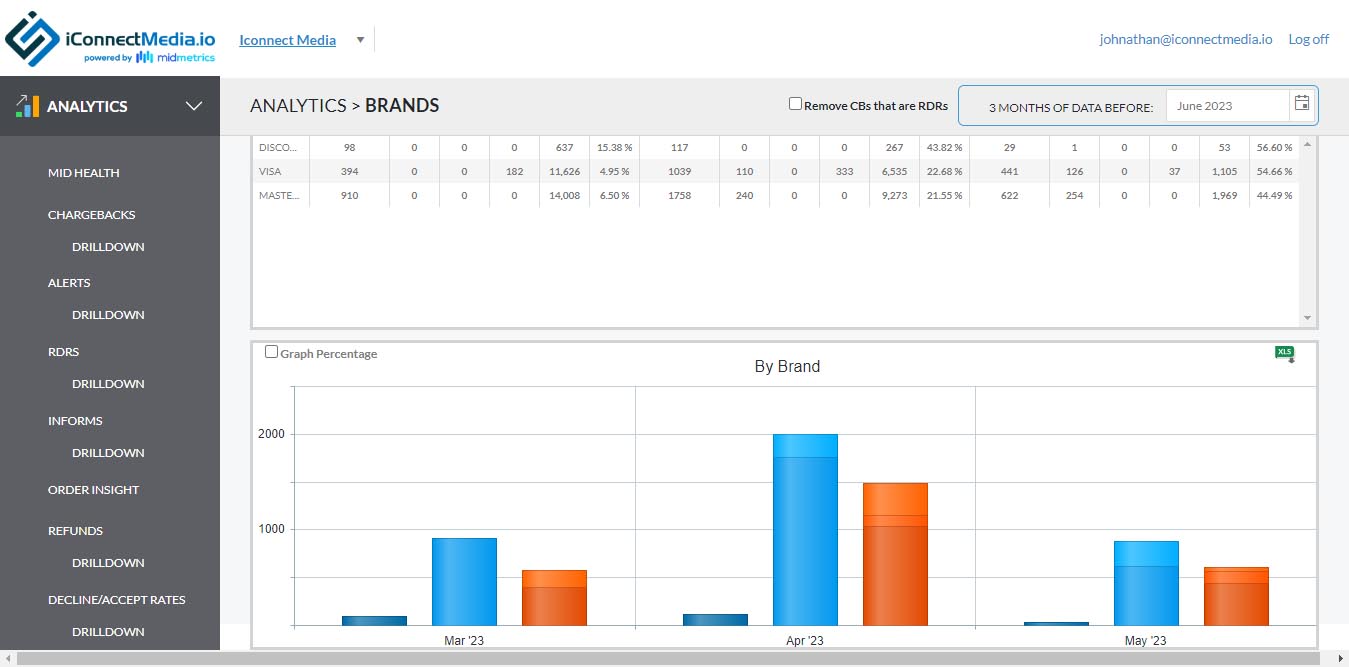

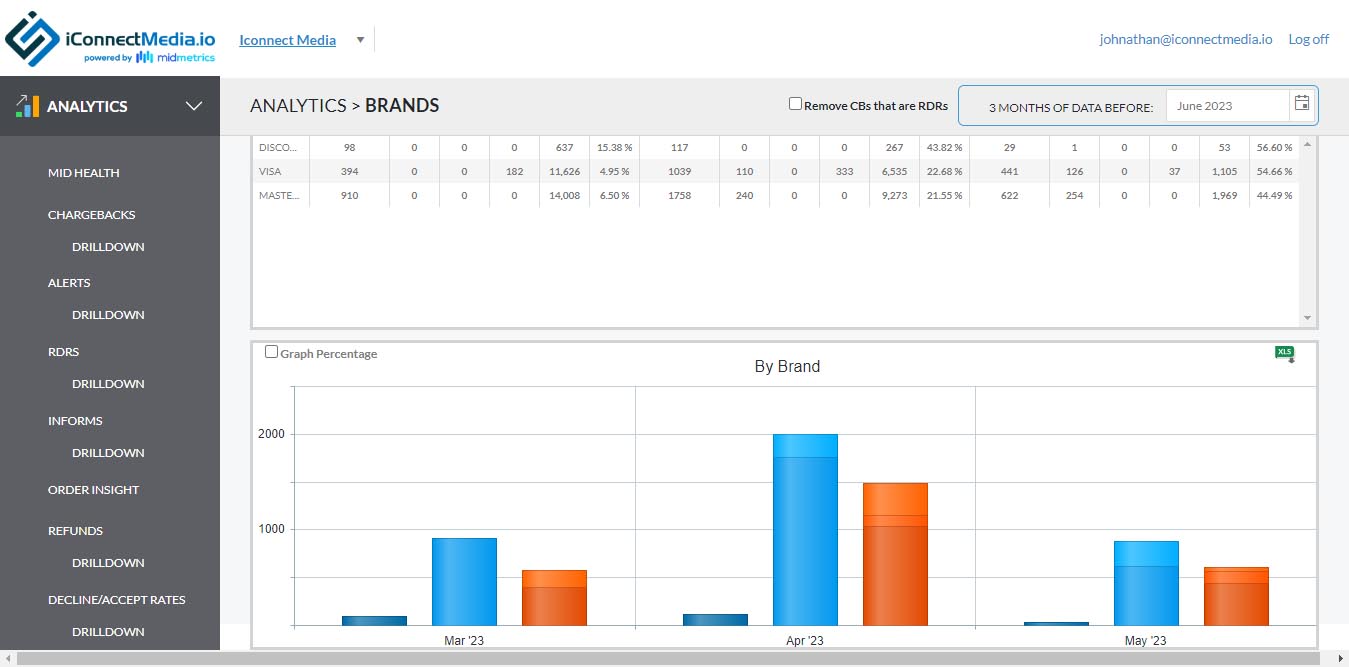

Chargeback analytics are the product of systematic computational analysis of chargeback data. They go beyond merely looking at the chargeback reason codes or the original transaction details. For MidMetrics, our chargeback analytics platform presents this information in the form of multifaceted, customizable dashboards that give you a comprehensive, detailed look at your chargebacks.

A proper chargeback analytics platform should allow you to both:

- View your chargeback data in broad, customizable categories in order to get an understanding of key chargeback trends; and

- Drill down into the details of particular categories of chargebacks or even individual chargebacks in order to glean insights from those more specific examples.

You could concoct a DIY solution, such as manually entering them into a spreadsheet. Or you could employ sophisticated chargeback analytics dashboards.

Any merchant who is worried about protecting their merchant accounts, particularly high-risk merchants. These sorts of chargeback management tools can help increase customer retention, streamline business operations, and reduce fraud and consumer disputes. Chargeback analytics offers an additional layer of protection combined with prevention alerts. Comprehensive analytics can help you reduce eCommerce fraud, affiliate fraud, and illegitimate chargebacks.