Chargeback Prevention Alerts

Strategies to prevent chargebacks begin with chargeback alerts. To protect your business from chargebacks, you need a solution that allows you to immediately receive and easily respond to alerts.

Why Do I Need Chargeback Alerts?

Chargebacks operate according to several overlapping timetables and deadlines amongst the various stakeholders in the payments process. Unfortunately, the merchant is left uninformed throughout this process until the end, leaving few options and limited time for a response to customer disputes. Chargeback alerts bring the merchant into the loop from the outset, sending the merchant a notification whenever a consumer contacts their issuer to initiate a chargeback. This early notification gives the merchant the opportunity to respond in a number of different ways—including issuing a refund or preparing to dispute or accept the chargeback. Thanks to the alert, the merchant has a wider array of possible responses and a longer timetable to make decisions.

Why Should I Choose iConnectmedia?

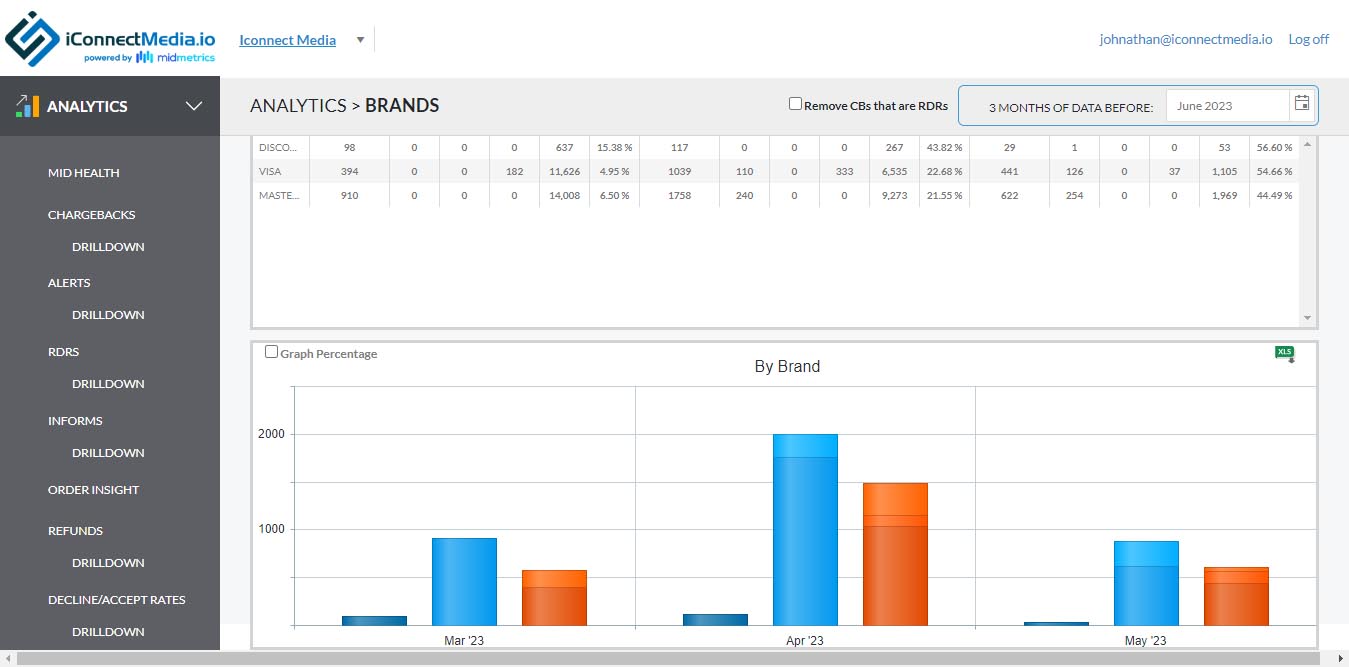

iConnectmedia offers alerts from both of the leading providers, Verifi and Ethoca, in a platform that simplifies managing and responding to alerts. iConnectmedia alerts are sent to the merchant immediately. They function in tandem with our analytics dashboards and serve as an easy platform for responding to and working alerts.

Chargeback Prevention Alerts Features

Frequently Asked Questions

Chargeback prevention alerts are a warning to a merchant that a chargeback will soon be filed. The two primary alerts providers are Verifi (for Visa transactions) and Ethoca (for Mastercard transactions).

It is possible to subscribe to the chargeback prevention alert networks on your own. But keeping those alerts organized and properly responding to them can be cumbersome. There are also sometimes issues in which banks notify both Ethoca and Verifi about a single chargeback, resulting in duplicate alerts and fees. A good third-party alerts provider makes it easier to organize and manage alerts as well as providing solutions to problems such as duplicate alerts. Additionally, third-party alerts can be packaged together with other chargeback management tools in a single platform.

Chargeback prevention strategies are complex and vary according to the particulars of each business. But any effective chargeback prevention strategy requires some sort of advance warning such as chargeback prevention alerts. If you don’t know that credit card chargebacks are incoming, it is very difficult to prevent them.

Chargebacks are expensive. Ethoca estimates that, on average, each chargeback costs merchants 2.5 times the original transaction amount. This statistic generally measures the direct costs of chargebacks, which come from lost revenue, chargeback fees (between $20-per-chargeback and $100-per-chargeback), and operational costs. There are also indirect costs relating to brand damage. And there are more severe consequences associated with excessive chargebacks.